|

Under a new bill, a restaurant would have to notify customers before a purchase if it plans to pass on a credit card processing fee. (pixabay.com). By Karin Price Mueller | NJ Advance Media for NJ.comHow closely do you examine the check when you dine in a restaurant?It may be time to start looking mo Show

Top 1: More restaurants are charging a fee to use a credit card. Here’s ... - njAutora: nj.com - 195 Avaliação

Descrição: Under a new bill, a restaurant would have to notify customers before a purchase if it plans to pass on a credit card processing fee. (pixabay.com). By Karin Price Mueller | NJ Advance Media for NJ.comHow closely do you examine the check when you dine in a restaurant?It may be time to start looking mo

Resultados de pesquisa correspondentes: Web11/6/2022 · When a business accepts credit and debit cards, it pays a percentage fee to the card processor, generally ranging from 1.5% to 3.5%. In the wake of higher inflation and ongoing supply chain issues ... ...

Top 2: How Much Of My Credit Card Limit Should I Use? - ForbesAutora: forbes.com - 145 Avaliação

Descrição: Find The Best Credit Cards For 2023. What Is Credit Utilization?. What Is a Good Credit Utilization Ratio?. How Does Credit Utilization Affect My Credit Score?. How Much of My Credit Card Limit Should I Use?. How Can I Increase My Credit Card Limit?. Find the Best High Limit Credit Cards of 2023 E

Resultados de pesquisa correspondentes: Web12/7/2022 · Many factors impact your credit score. Credit utilization, or the amount of credit used versus the total credit extended to you, is one of the most important factors impacting a credit score ... ...

Top 3: Can You Use a Credit Card on Cash App? | GOBankingRatesAutora: gobankingrates.com - 144 Avaliação

Descrição: Can You Link a Credit Card to Cash App?. How Can You Add a Credit Card to Cash App?. Can You Send Money through Cash App from a Credit Card?. Is Using a Credit Card on the Cash App Considered a Cash Advance?. Why Can’t You Link Your Credit Card on the Cash App?. Why Was Your Credit Card Payment on the Cash App Declined?.

Resultados de pesquisa correspondentes: Web6/10/2022 · Cash App is a prominent mobile banking application that is available in the United States and the United Kingdom. It is a financial services platform that is owned by Block. Cash App provides features like money transfer, payments, direct deposits and even investing. See Why This Credit Score Mistake Could Be Costing Millions Of Americans It … ...

Top 4: Should You Increase Your Credit Card Limit? - InvestopediaAutora: investopedia.com - 159 Avaliação

Descrição: Increase Your Credit Score . Benefits of Credit Limit Increase vs. New Card . How to Ask for a Credit Limit Increase . Should You Increase Your Credit Limit? . 6 Benefits Of Increasing Your Credit Limit At one time in your life, you have likely noticed a boost in the amount of. available c

Resultados de pesquisa correspondentes: Web10/6/2021 · For example, let’s assume that you started with a credit limit of $1,000 and regularly have $800 charged onto the card—that means your credit utilization is at 80%. ...

Top 5: Images You Should Not Masturbate To Paperback - amazon.comAutora: amazon.com - 127 Avaliação

Descrição: Brief content visible, double tap to read full content.Full content visible, double tap to read brief content.After being rudely interrupted by a 30-year career in advertising, Graham is now writing books and producing products under the guise of the Elsewhere Trading Co. Graham has re-assessed his

Resultados de pesquisa correspondentes: Web1/2/2011 · Images You Should Not Masturbate To [Johnson, Graham, Hibbert, Rob] on Amazon.com. *FREE* shipping on qualifying offers. Images You Should Not Masturbate To ... Our payment security system encrypts your information during transmission. We don’t share your credit card details with third-party sellers, and we don’t sell your ... ...

Top 6: Here's why you should use a credit card instead of a debit cardAutora: foxbusiness.com - 138 Avaliação

Descrição: The four biggest benefits of. using credit. Recap: Why should you choose credit over debit?. Extra time to pay back costs . There are four big benefits to utilizing available credit. (iStock)There's nothing like a pandemic to make modern consumers question financial habits — particularly spendin

Resultados de pesquisa correspondentes: Web26/8/2020 · Why use a debit card that offers zero rewards when you can use a credit card and get 1-3% cashback per transaction alongside other perks all year long? As an example, say a consumer spends $1,000 ... ...

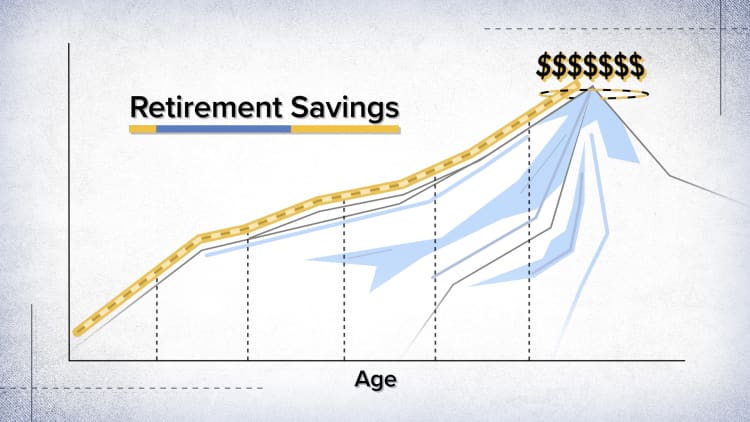

Top 7: Should you use your 401(k) to pay off credit card debt? What the ... - CNBCAutora: cnbc.com - 179 Avaliação

Descrição: Douglas Rissing | iStock | Getty ImagesThose who've been stuck with a credit card balance may wonder if they should use the savings in their 401(k) plan to clear their debt up.Credit cards, after all, come with high interest rates — the average charge is over 16% a. year. Being dinged at that rate, i

Resultados de pesquisa correspondentes: Web24/8/2021 · Those who've been stuck with a credit card balance may wonder if they should use the savings in their 401(k) plan to clear their debt up. Credit cards, after all, come with high interest rates ... ...

Top 8: Invariant failed: You should not use outside aAutora: stackoverflow.com - 166 Avaliação

Descrição: I use react-router-dom for routing in my React application. Part of my app extracted in another package. List of dependencies looks like this:./app/dashboard/package.json{. "dependencies": {. "@app/components": "^1.0.0",. "react": "^16.8.5",. "react-dom": "^16.8.5",. "react-router-dom":

Resultados de pesquisa correspondentes: Web29/4/2019 · If you are using webpack, you can change the way it will resolve the react-router-dom module. You can overwrite the default order in which webpack will look for your dependencies and make your parent application node_modules more prioritized than component node module resolution order: aliases.js ...

Top 9: Credit Card Pre-Approval | DiscoverAutora: discovercard.com - 95 Avaliação

Descrição: If you would like to receive your pre-approval decision and your application decision electronically and, if approved, receive future disclosures and other important information about your Discover card Account electronically instead of paper, please read and accept the terms and conditions below.

Resultados de pesquisa correspondentes: WebPlease read the following important information about receiving disclosures electronically. You agree that we may provide you with your pre-approval decision and application decision and, if approved, any disclosures, notices or other information (collectively "disclosures") legally required in connection with your Discover card Account … ...

Top 10: 5 Expenses You Should Never Charge On A Credit Card - CNBCAutora: cnbc.com - 120 Avaliação

Descrição: 1. Your monthly rent or mortgage payment. 2. A large purchase that will wipe out available credit. 5. A series of small impulse splurges The Chase Slate® is not currently available to new cardholders. Please visit our list of the best balance transfer cards and. best Chase cards for a

Resultados de pesquisa correspondentes: The 5 types of expenses experts say you should never charge on a credit card · 1. Your monthly rent or mortgage payment · 2. A large purchase that will wipe out ...The 5 types of expenses experts say you should never charge on a credit card · 1. Your monthly rent or mortgage payment · 2. A large purchase that will wipe out ... ...

Top 11: 10 Things You Shouldn't Use Your Credit Card ForAutora: creditcard.com.au - 126 Avaliação

Descrição: 1. Starting a business. 6. Paying off other debts. 7. Major medical bills. 8. Recurring payments Cards are a fast way to pay at the checkout, a secure option when travelling and easy to set up as a payment option for online shopping. There’s plenty of good reasons to pay with plastic, but when is i

Resultados de pesquisa correspondentes: 4 Apr 2022 · 1. Starting a business · 2. Home renovations · 3. Buying a used car · 4. Gambling · 5. Hotel extras · 6. Paying off other debts · 7. Major medical ...4 Apr 2022 · 1. Starting a business · 2. Home renovations · 3. Buying a used car · 4. Gambling · 5. Hotel extras · 6. Paying off other debts · 7. Major medical ... ...

Top 12: 10 Things You Should Never Buy With a Credit CardAutora: gobankingrates.com - 139 Avaliação

Descrição: 9. Down Payments of Any Kind. 10. Business Startup Expenses mediaphotos / Getty Images Building credit and racking up credit. card rewards can be great for your finances but putting certain items on your card leads to big fees and higher interest rates, which cancel out any benefits. The Future of

Resultados de pesquisa correspondentes: 8 Dec 2022 · 10 Things You Should Never Buy With a Credit Card · 1. Mortgage Payments · 2. Small Indulgences · 3. Cash Advances · 4. Household Bills · 5. Medical ...8 Dec 2022 · 10 Things You Should Never Buy With a Credit Card · 1. Mortgage Payments · 2. Small Indulgences · 3. Cash Advances · 4. Household Bills · 5. Medical ... ...

Top 13: 10 Things You Should Never Use Your Credit Card for - PersonalFNAutora: personalfn.com - 159 Avaliação

Descrição: Aug 18, 2022 Listen to 10 Things You Should Never Use Your Credit Card for 00:00 00:00 A credit card is a pre-eminent financial tool that opens a short-term line of credit and increases the purchasing power of the. cardholder. Paying through credit cards is considered a secure, faster, and easier p

Resultados de pesquisa correspondentes: 18 Aug 2022 · 10 Things You Should Never Use Your Credit Card for · 1. Monthly Household Expenses: · 2. EMIs: · 3. Big Purchases: · 4. Small Indulgences: · 5.18 Aug 2022 · 10 Things You Should Never Use Your Credit Card for · 1. Monthly Household Expenses: · 2. EMIs: · 3. Big Purchases: · 4. Small Indulgences: · 5. ...

Top 14: 9 Reasons to Say No to Credit - InvestopediaAutora: investopedia.com - 122 Avaliação

Descrição: 1. Credit Discourages Self-Control . 2. It Likely Means You Don’t Have a Budget . 3. Interest Is Expensive . . 4. Rates Can Rise with Unpaid Balances . 5. A Poor Credit Score Affects a Lot . 6. Bad Habits Risk Your Relationships 7. Financing Leads to More Spending . 8. It Can Lead to Bankruptcy . 9. It Can Erode Your Peace of Mind .

Resultados de pesquisa correspondentes: The major downsides of using credit when you don't have the cash to pay it off later—besides the high-cost interest—includes hurting your credit, straining ...The major downsides of using credit when you don't have the cash to pay it off later—besides the high-cost interest—includes hurting your credit, straining ... ...

Top 15: 6 Major Credit Card Mistakes - InvestopediaAutora: investopedia.com - 108 Avaliação

Descrição: Only Paying the Minimum Balance . Using a Credit Card for Everyday Items . Chasing Credit Card Rewards . Taking Cash Advances . Using a Credit Card to Pay Medical Bills . Ignoring Your. Debt . Other Mistakes to Avoid . Is it bad to use a credit card?. Should I use credit card for medical bills?. Are credit card rewards worth it?. Maxing Out the Credit Card Credit Line . Not Understanding Terms of the Account Agreement .

Resultados de pesquisa correspondentes: It's tempting to send in minimum monthly payments—often $15 to $25—when you're under financial duress. Don't do it. High-interest rates charged by credit card ...It's tempting to send in minimum monthly payments—often $15 to $25—when you're under financial duress. Don't do it. High-interest rates charged by credit card ... ...

Top 16: How NOT to Use a Credit Card - 10 Uses You Should Avoid at All ...Autora: moneycrashers.com - 136 Avaliação

Descrição: Have you ever heard someone talk about how they use their credit card and just had to shake your head? Though the Internet is filled with good advice on how to use credit cards and rewards wisely, some people are just not getting the message.Of course, what’s really going on is they’re getting a dif

Resultados de pesquisa correspondentes: How NOT to Use Credit Cards · 1. Sign Up for Every Credit Card You See · 2. Never Pay Your Bills in Full · 3. Don't Make Your Payments on Time · 4. Always Pay ...How NOT to Use Credit Cards · 1. Sign Up for Every Credit Card You See · 2. Never Pay Your Bills in Full · 3. Don't Make Your Payments on Time · 4. Always Pay ... ...

Top 17: Which Purchases Should Go On a Credit Card? - TimeAutora: time.com - 126 Avaliação

Descrição: Always Use a Credit Card for These Purchases. Choosing the Best Card for You. Electronics and Appliances. Event Tickets and. Passes . Getty Images/CapuskiWe want to help you make more informed decisions. Some links on this page — clearly marked — may take you to a partner website and may result in u

Resultados de pesquisa correspondentes: 4 Nov 2022 · Whether you're buying a smart refrigerator or an OLED TV, using a credit card to pay for electronics and appliances is a smart idea. These are ...4 Nov 2022 · Whether you're buying a smart refrigerator or an OLED TV, using a credit card to pay for electronics and appliances is a smart idea. These are ... ...

Top 18: What Happens If You Don't Use Your Credit Card? – Forbes AdvisorAutora: forbes.com - 156 Avaliação

Descrição: Find The Best Credit Cards For 2023. What Happens If You Don’t Use Your Credit Card. Should I Close a Credit Card I Never Use?. Best 0% APR & Low Interest Credit Cards Of 2023. Your Account May Get Closed. Your Credit Score May Drop Editorial Note: We earn a commission from partner links on Forbes

Resultados de pesquisa correspondentes: 1 Dec 2022 · Credit cards are useful for everyday spending, large one-time purchases, balance transfers to take advantage of a lower interest rate and ...1 Dec 2022 · Credit cards are useful for everyday spending, large one-time purchases, balance transfers to take advantage of a lower interest rate and ... ...

|

Postagens relacionadas

Publicidade

ÚLTIMAS NOTÍCIAS

Publicidade

Populer

Publicidade

direito autoral © 2024 cemle Inc.